In honor of my beloved Seattle Mariners making it to the ALCS, this post is titled “China’s brush-back pitch.” For those who want to know more about what that is, click here, a video here, and a scientific evaluation.

It was an interesting beginning of the week here in China. I say 'beginning' because the week started on Thursday, after the October and Mid-Autumn Festival holidays. China implemented new export controls on October 9th, and the rollercoaster since then has been a spectacle.

The gnashing of teeth from many was expected, but also missed the mark: “China weaponized the entire rare earth supply chain,” or did this “to give leverage in trade negotiations”, or is using a “blackmail tactic.”

Did this come out of nowhere? Did the Chinese government wake up after the holiday Thursday morning and say, “We need to press for leverage now and put in controls!?” No. Most of these regulations have been in place for years, some since 2020, but have yet to be implemented.

What changed for China to implement new controls and react this way?

Trade War 2.0 started in April with a volley of tariffs and then reciprocal tariffs between the US and China. China ultimately cut off magnet and other exports in retaliation, and once US factories started closing, the Trump Administration sued for peace via a negotiated “truce” in May 2025.

May 2025: U.S. and Chinese officials agreed to a 90-day tariff truce after two days of negotiations in Stockholm.

The truce paused new tariff hikes and allowed both sides to explore a trade framework.

June–August 2025: The truce held, with both sides avoiding major escalations.

Discussions focused on energy, agriculture, and semiconductor trade.

A summit between President Trump and President Xi was tentatively planned for the fall.

China’s understanding was that this was a broad, overarching truce, where both sides would refrain from taking provocative actions. But during this time, various departments of the Administration continued to whittle away at China, most reasoning given as “this is done in the interest of National Security.”

Here are some of the actions taken since the Spring of 2025 against Chinese firms:

Entity List Additions

March 25, 2025:

BIS added 80 entities to the Entity List, including firms from China, the UAE, South Africa, Iran, Taiwan, and others.September 16, 2025:

BIS added 23 Chinese firms for activities deemed contrary to U.S. national security and foreign policy interests, Federal Register.Subsidiary Crackdown:

BIS closed loopholes by blacklisting Chinese offshoots and subsidiaries of previously banned firms, The Register.

Export Control Enhancements

Advanced Computing & AI Restrictions:

BIS expanded controls to block Chinese access to exascale computing, AI chips, and supercomputers under the “small yard, high fence” strategy, CNBC.Quantum & Military Tech:

New rules aim to prevent Chinese military-linked entities from acquiring U.S. technologies for quantum sensing, navigation, and communications, bis.gov.

Commerce Secretary Statement:

Howard Lutnick emphasized: “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives.” The Register

Maritime Actions

Target China’s dominance in the maritime, logistics, and shipbuilding sectors, beginning on October 14th.

Key Measures:

Port service fees on vessels that are:

Built in China

Owned or operated by Chinese entities

Financed by Chinese lessors

Links:

CNBC | MSNMSN – Port fees on Chinese-built ships

Reuters | MSNMSN – USTR adjusts penalties on foreign-built ships

United States Trade RepresentativeUSTR – Section 301 Action on Maritime Sectors

The cherry on top of the US export control sundae came September 29th: The Bureau of Industry and Security’s (BIS) 50/50 Rule. This rule extended restrictions to any foreign entity that is 50% or more owned—individually or collectively—by one or more parties already on the Entity List or Military End-User (MEU) List.

What the 50/50 Rule Does

Automatic Coverage:

Any entity that is 50% or more owned, directly or indirectly, by one or more listed parties is now subject to the same export restrictions—even if it’s not named on the list.Aggregate Ownership:

The rule applies to combined ownership—for example, if two listed entities each own 25% of a third company, that company is covered.Modeled After OFAC:

BIS adopted this rule based on the U.S. Treasury’s Office of Foreign Assets Control (OFAC) standard, which has been used for sanctions enforcement.

Additional Provisions

Red Flag Trigger:

Significant minority ownership (under 50%) by a listed entity now triggers enhanced due diligence for exporters.“Most-Restrictive Owner” Standard:

If multiple listed owners are involved, the entity inherits the strictest applicable restrictions.Foreign Direct Product (FDP) Rule Updates:

BIS made conforming changes to ensure that foreign-made items using U.S. technology are also covered under the new ownership rule.

🧭 Strategic Impact

This rule closes a potential loophole that could allow firms to circumvent export controls by using subsidiaries or affiliates not explicitly listed. It significantly expands the reach of U.S. export restrictions and increases compliance costs.

Sources: bis.gov Davis Polk National Law Review Paul, Weiss

China’s Brush-back Pitch

After these actions, China had had enough. What was thought to be a “truce” for the Chinese seemed like the US taking advantage of the pause and continuing to attack and erase business opportunities for Chinese firms, further restricting Chinese access to technology, and affecting the travel of Chinese citizens.

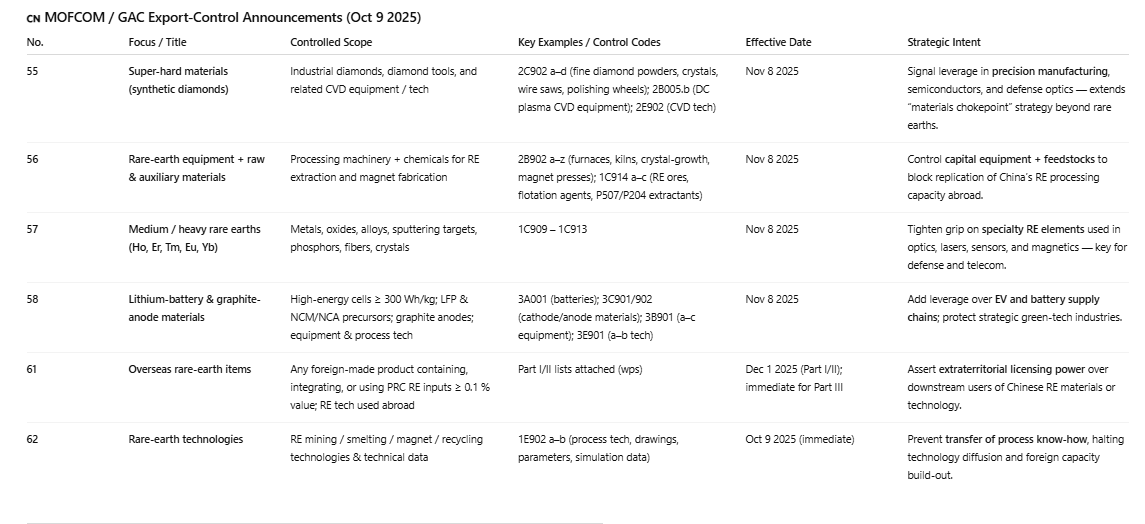

Here are the recently announced controls, as posted by Gerard DiPippo:

You can find the original documents and links here:

No. 55, No. 56, No. 57, No.58, No. 61, No. 62, the original April 4, 2025 announcement

The Chinese government sees this as a calibrated, mirrored response to escalating U.S. trade and technology restrictions.

What these controls REALLY mean and their purpose

These controls go far beyond normal export control procedures (just as US controls did regarding semiconductors and other technology). This is not really aimed at negotiations and related flexing before possible meetings (it is, however, a secondary benefit, but not the purpose).

These controls are China saying Stop screwing around with us, they are a “brush-back pitch”. The United States continues to misread China’s strategic intent—and that miscalculation is becoming dangerous. Washington is acting as if policy is theater and needs to start grappling with the real-world consequences of its decisions, including the second- and third-order effects that ripple across industries, alliances, and time.

A follow-up post will discuss the recent “make-up” announcements of the Ministry of Commerce and President Trump.

Nice factual article.

Go Jays!